Our Top 8 Tips for How to Talk to Your Parents About Outsourcing Their Bill Payment

When it comes to discussing financial matters with high-net-worth parents, the conversation can be more complex than with the average household. High-net-worth individuals often have multiple investments, assets, and financial complexities that require careful management. If you’re considering broaching the topic of outsourcing bill payment for your high-net-worth parents, it’s crucial to approach the conversation with sensitivity, respect, and a focus on their financial well-being.

- Understand Their Financial Landscape

Before initiating the conversation, take the time to thoroughly understand your parents’ financial situation. This includes their assets, investments, income sources, liabilities, and financial goals. High-net-worth individuals typically have diverse financial holdings, and it’s essential to grasp the big picture.

- Emphasize the Benefits

Highlight the advantages of outsourcing bill payment with an experienced and hands-on team like Plumb. Mention how it can optimize their financial management by ensuring that no payments are missed, preventing late fees, and streamlining record-keeping. Emphasize that not only can this free up their time for more strategic financial planning and investment decisions, but it will give them more time to enjoy their lives and do what they love – whether traveling, spending time with friends and family, or just relaxing.

- Address Their Concerns

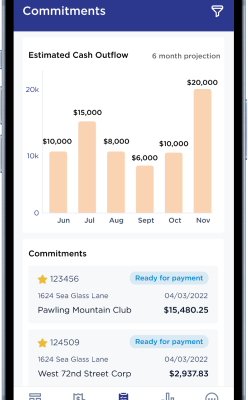

Acknowledge that your parents may have concerns about relinquishing control over their financial affairs. Listen actively to their worries and address them one by one. Discuss how they can maintain oversight and retain decision-making authority while delegating routine tasks. At Plumb, we understand these concerns and hear them from prospective clients almost daily. In fact, we created our proprietary Bill Pay App specifically for our clients. Our app provides bill pay transparency and insights that we know our clients want. Read more about our app here.

- Present Professional Options

Research and present professional options for outsourcing bill payment, like Plumb. We have a proven outsourced bill pay solution, including a proprietary bill pay app, with high-touch customer support, and expert bill pay accountants who ensure bills are paid accurately and on time.

- Discuss Privacy and Security

Assure your parents that their privacy and financial security are paramount. Choose a service provider like Plumb with bank-level security and a strong track record of safeguarding sensitive financial information. Explain the robust security measures in place to protect their data – you can learn more about Plumb’s focus on confidentiality and security here.

- Transparency in Costs

Be transparent about the costs associated with outsourcing bill payment services or hiring financial advisors. At Plumb, we are very upfront with our fees and take the time needed to walk our clients through exactly what they can expect in return.

- Ensure a Comprehensive Approach

When discussing outsourcing, stress the importance of a comprehensive approach to financial management. Explain that the chosen service provider will work in tandem with your parents’ existing financial team, including accountants, attorneys, and investment advisors – just as we do here at Plumb.

- Offer Ongoing Support

After the decision is made, offer ongoing support to ensure a smooth transition, but work with a bill pay service provider who will make this an easy and pain-free change. You’ll also want to find a firm like Plumb who offers high-touch, full-access client support.

Broaching the subject of outsourcing bill payment for high-net-worth parents is a delicate but necessary conversation that can enhance their financial well-being and peace of mind. By approaching this topic with empathy, knowledge, and a focus on their specific needs, you can help your parents make informed decisions that optimize their financial management while respecting their autonomy and preferences. Ultimately, this can contribute to their financial security and their overall happiness.

Plumb delivers financial peace of mind by assisting high-net-worth individuals and family offices know where their money is going, so their trusted advisors can effectively manage it. We work in partnership with their team — including wealth, CPA, and other advisors — to provide the highest quality of data and financial reporting to establish a holistic view of their assets and financial holdings. We’d love to help answer any questions you may have. Feel free to schedule time to speak with Anneke Stender, our EVP, at your convenience.