Providing an Entrepreneur with Up-to-Date & Consolidated Financial Data for a Clear Picture of Wealth

Case Study: Ultra-High-Net-Worth Investor & Business Owner

Client:

Ultra-high-net-worth entrepreneur with multiple business investments, rental properties and luxury yacht.

Net-Worth:

$150 Million +

Background:

An entrepreneur who recently sold one of his businesses needed help with his personal accounting, tracking of income, cash flow reporting and bill pay. As he started to invest in additional businesses, he was also looking for an accounting team who could provide him with accurate GAAP compliant financial statements for his new investments.

A snapshot of his financial life included multiple operating businesses, existing holdings, and real estate assets.

Referencing an article in the New York Times, “Inside the Minds of the Ultrawealthy” by Eilene Zimmerman, she asked psychologist Brad Klontz about what it’s like to work with billionaires.

What can the rest of us learn from how the ultra-high-net-worth work through their problems?

The ultra-high-net-worth are not afraid to ask for help. They are more likely to have an internal locus of control, where they are quick to take credit for their successes and admit their failures, at least to themselves. In managing their very complex lives, they have had to rely on a variety of experts to help them along the way. When they run into problems, they are less hesitant than most of us to seek help from someone who is an expert.

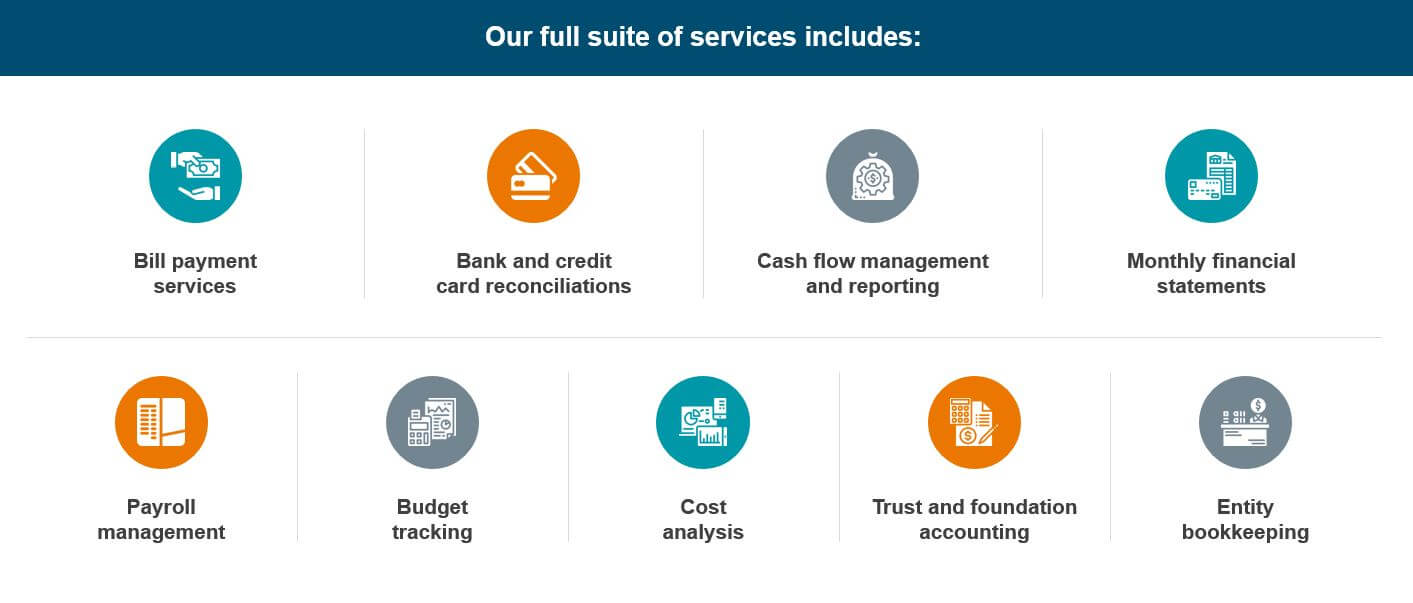

Solution & Deliverables:

Plumb Family CFO delivers a customized approach for every client, depending on their needs and complexity of their financial lives.

This Client’s concerns revolved around the accuracy of the data his property management company was providing. He was also seeking accounting assistance for a newly acquired construction business that needed cleaned-up financials and advice moving forward with company performance and strategy.

Personal Reporting & Outsourced Accounting:

- Create a consolidated trust balance sheet every month

- Track all transactions and properly allocate

- Implement calendar of financial due dates for all rental properties to ensure mortgages, property taxes, insurance and utilities are paid on time

- Work in conjunction with property management firm to receive accurate data

- Set-up internal controls and accounting procedures to track new business entities, trusts and partnerships

- Track and consolidate investment funds

- Reconcile all balance sheet accounts, including Cash, AR, AP and credit card liabilities

- Project work for establishing up-to-date and accurate financial statements for newly acquired business

- Maintain yacht slips and make sure invoices are paid on time

- Ongoing strategic advice on company performance

Outsourced Bill Pay:

- Forwarding bill statements to client-specific PO Box

- Sending the Client a comprehensive list of bills for approval of payment

- Paying bills out of a POA designated bank account

- Processing checks that Plumb signs as Power of Attorney

- Performing monthly bank and credit card statement reconciliations

- Electronically filing invoices to a secured client-specific cloud folder

- Setting up bill pay schedule with financial calendar of due dates

- Integrating bill pay schedule into Plumb’s proprietary task management software

- Implementing vendor management reporting

- Creating weekly cash flow reports

- Properly tracking income & expenses

Results – How We Help:

The Client was able to offload many personal accounting and bill pay tasks to Plumb Family CFO. He gained financial clarity and peace of mind knowing that his day-to-day transactions were being handled With consolidated reporting every month, he was able to see a clear picture of his net-worth and had more time to optimize his investment strategies. With ongoing corporate outsourced accounting and strategic advice on a CFO-level, the Client receives recommendations on industry-specific trends with the companies that he has ownership in.

Ready for financial peace of mind?

Related Posts:

Request a Quote for Bill Pay Services:

Oops! We could not locate your form.