Managing the bill payments for high net- and ultra-high net-worth individuals (HNWI/UHNWI) clients is a time-consuming and often frustrating task. Tracking down potential discrepancies, monitoring fraudulent transactions, working with vendors, and doing regular reconciliations are critical to maintain your client’s trust but take valuable time away from more strategic functions.

By working with a partner who specializes in bill payment for HNWI/UHNWI clients, you can spend less time in the accounting weeds and more time on high-value services. Plumb personal bill payment services handle the details of monthly personal bills and expenses.

Unique client requirements

As a trusted advisor to a special class of clients, you can’t risk working with inexperienced partners. At Plumb, we are laser focused on helping financial professionals like you serve HNWI/UHNWI and family offices. We have a proven track record of delivering bill payment, accounting, and financial reporting services to the clients you serve.

Proven HNWI/UHNWI client bill pay processes

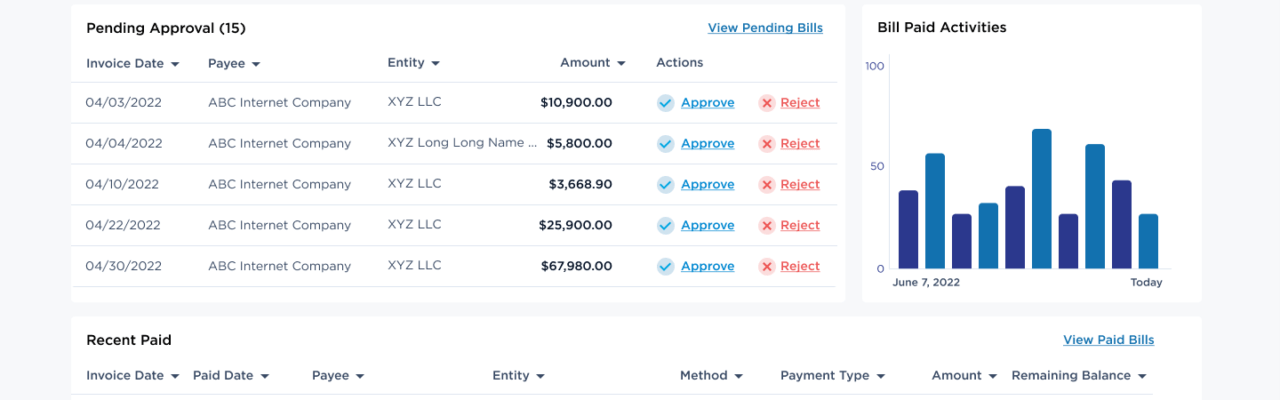

Because bill payment services are one of the most time-consuming accounting tasks for HNWI/UHNWI clients, it makes good sense to consider outsourcing. A turnkey bill pay service should be designed to manage all the details of your client’s accounting, payment, and vendor management. At Plumb, accounts are closely monitored to identify any discrepancies or questionable transactions. Cash flow reporting, expense tracking, and bill payment are handled reliably and securely. Approving bills, viewing bill payment status, and communicating with the Plumb team takes full advantage of modern technology.

State-of-the-art technology supports better reporting

To maintain the levels of service your clients expect, bill payment needs to be managed by experts in both the Family Office space and the best-performing software for this niche audience. Plumb utilizes Sage Intacct which can provide you with clear, detailed information that allows you to answer questions instantly. The automated processes of Sage Intacct simplify multi-entity consolidations, streamline bill payment, and provide timely reporting—all while reducing manual processes that take time away from higher-level services

Practices and processes to ensure data security

Security must always be top-of-mind for any service you provide to clients. Plumb’s bank-level security practices include real-time, 24/7 network monitoring and detection from in-house IT professionals. In addition to good data security practices, bill payment services should also have tight process controls in place.

Segregation of duties in bookkeeping and financial management provide an added level of security protection for your clients. Sage Intacct’s bill payment platform has checks and balances built in through automated processes. Plumb’s bill payment services include multiple sets of examinations to prevent fraud and ensure accuracy.

Learn more about the tools you can leverage to manage HNWI/UHNWI clients

To help you focus on the most important aspects of working with your clients, including bill pay, please check out the ebook 6 Essential Tools to Help You Manage HNWI/UHNWI Clients: Your Guide to Ensure Financial Clarity and Data Security.

When you entrust the accounting, reporting, and data security details to true experts, you can focus on deeper, personalized, and even more strategic service delivery to your HNWI/UHNWI clients.

Plumb Family Office Accounting & Bill Pay is a high-touch technology family office accounting and bill pay service provider dedicated to serving the needs of high-net-worth and ultra-high-net-worth clients. Plumb ensures that your client’s bills are paid on time and works in partnership with you to deliver the highest quality data and financial reporting. In addition to our bill pay services, we also provide comprehensive Family Office Accounting support.

Let’s talk about how we can help you build stronger relationships with your clients.