We are thrilled to share that Plumb has appointed George Logemann as our new Chief Technology Officer (CTO). George joins our team with extensive experience in financial technology and a fresh perspective that will drive our company to greater heights. As a key member of our leadership team, George will play a central role in shaping and implementing our technology vision here at Plumb. George will lead software development, focusing on multiple phases of strategic enhancements and innovations aimed at delivering exceptional value to our clients.

With three decades of expertise in building financial technology for investment and wealth management enterprises, George’s background is impressive. Notably, he dedicated over 13 years to Citadel, a leading hedge fund in the US. At Citadel, George held various pivotal roles, including CTO and COO of Global Commodities, overseeing trading and risk technology as well as operational aspects for the firm’s commodities strategies. He also spearheaded the creation of Citadel’s firm-wide back office platform, capable of capturing millions of daily transactions and supporting all portfolio management, operations and accounting processing. Beyond Citadel, George has dedicated several years to crafting cloud-based aggregation and operational workflow solutions for the financial advisory sector.

George’s extensive background in financial technology and operations makes him a valuable addition to Plumb. We anticipate leveraging his leadership and experience as we develop our comprehensive technology strategy and deliver top-tier solutions for our clients. As CEO and President Rob Scherer shares, “George brings such a cool edge and innovative creative process to our team. I am excited to see how he can expand the app and guide our technology team to new levels.”

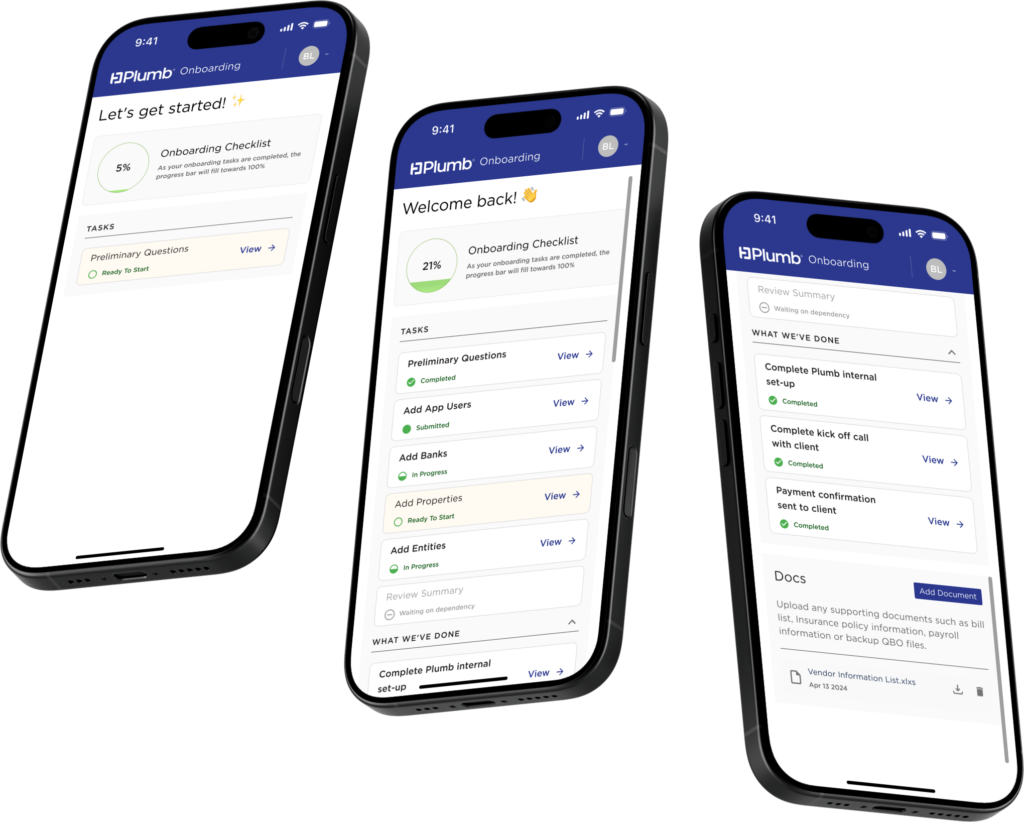

George has already embarked on this mission by beginning to evolve our Plumb Bill Pay App into a comprehensive, interactive financial data platform. This expansion aims to offer clients not only convenience but also valuable insights and interactive reporting features that empower them to take control of their financial health.

Unlike static reports, interactive reporting will allow clients to engage with their financial data dynamically. Plumb is utilizing a scalable data warehouse, Snowflake, in tandem with the Plumb Bill Pay Application platform to obtain and pull from client data, offering robust reporting and significant insights. The enhanced platform will enable clients to gain intuitive access to their information, customize dashboards, visualize trends, predict future cashflows, and receive real-time alerts and recommendations.

By transforming the app into a multifaceted data insights tool, we are not only enhancing its value proposition but also helping users gain a deeper understanding of their finances. This initiative will set a new standard in the fintech industry, demonstrating how technology can be harnessed to provide meaningful and interactive financial insights.

As we embark on this exciting journey, we are confident that George’s vision and expertise will enhance our technological capabilities, foster a culture of innovation, and propel us toward achieving our strategic goals.

George shares, “Plumb’s leadership team cares about providing a high-quality client experience, and they have outlined an innovative strategy. I am very excited to engage in this endeavor to help shape the future of the application suite and build solutions that will set us apart from other providers.”

We look forward to the positive impact George will make and the advancements we will accomplish together.