Reconcile a Brokerage Statement in QuickBooks: How-To Video Instructions

In this accounting tips video, you will get step-by-step instructions on how to read and reconcile a brokerage statement in QuickBooks.

Before you reconcile a brokerage statement in QuickBooks, it is important to understand the basics of what a brokerage account is.

Consider outsourcing your QuickBooks accounting needs – Plumb provides outsourced accounting services, specializing in QuickBooks software for companies and high-net-worth families who need help with bill pay, and personal reporting.

Book a free consultation with a QuickBooks expert

What is a brokerage account? A brokerage account is an arrangement between an investor and a licensed brokerage firm that allows the investor to deposit funds with the firm and place investment orders through the brokerage. The investor owns the assets contained in the brokerage account and must usually claim any capital gains as income as it incurs from the account.

Parts of a brokerage statement in QuickBooks

Account Information: basic information, such as the account owners, the time period covered, and the account number.

Statement Account/Summary: This section shows the investments performance as of the statement date by displaying unrealized and realized gains/losses. This also summarizes the total value of stocks, bonds, mutual funds, other investments, and any cash.

Portfolio Detail: This section identifies individual assets in the account and allows the investor to determine whether the holdings listed are accurate. This shows the value of the investments at the end of the statement period, cost basis of the investment, estimated income and yield, and other information, such as bond insurance ratings, stock symbols, and unrealized gains and losses.

Income Summary: This section displays the income and dividends earned by the investments for the statement period and the year-to-date.

Daily Activity: This section includes detailed information on all account activity during the statement period, including all security transactions (purchase and sales), management fees, detail of income received and miscellaneous deposits received and payments made.

Disclosures: This section includes legal and administrative e explanations, such as fee information, penalty warnings, and a description of some symbols used.

How to Set Up and Reconcile a Brokerage Statement in QuickBooks

Each Investment account should be setup as a separate “Other Asset” account on the Balance Sheet. A sub account will be setup for each Asset Class, and under each sub account or asset class, should include a sub account for the Cost, as well as the Market Value.

Account Example:

Charles Schwab XXXX

- Cash

- Mutual Funds

– Cost

– Market Value Adjustment

- Exchange Traded Products

– Cost

– Market Value Adjustment

- Stocks

– Cost

– Market Value Adjustment

- Bonds

– Cost

– Market Value Adjustment

Each Investment Account should have its own Income account for Dividends, Interest, Realized Gains and Losses, Capital Gains Distributions, and Miscellaneous Income.

Account Example:

- Interest Income

– Morgan Stanley XXXX

- Dividend Income

– Morgan Stanley XXXX

- Realized Gains and Losses

– Morgan Stanley XXXX

- Capital Gains Distributions

– Morgan Stanley XXXX

- Miscellaneous Income

– Morgan Stanley XXXX

Each Investment Account should have its own Management Fee account.

Account Example:

- Management Fees

– Morgan Stanley XXXX

Unrealized Gains and Losses will be adjusted monthly to an Equity Account. Each Investment Account will have its own account.

Account Example:

- Market Value Adjustment

– Morgan Stanley XXXX

Reconciling monthly or quarterly Brokerage Statements

A journal entry is typically used to record brokerage statement activity. The following transactions are standard for each entry:

- Investment Income: this includes dividends, interest, realized gains and losses, and capital gains distributions

- Sales and purchases of investments

- Investment management fees

- Transfers from one investment cash account to another investment cash account or bank account

- Unrealized gains and losses (market value adjustments) for each Asset Class

Other Notes

- Be sure to follow the Cash activity. Often time’s people will plug a number to reconcile Cash, which causes them to miss recording receipts, payments, or transfers.

- Capital gains distributions are typically paid at the end of the year, usually in November and December.

- Management Fees are typically paid in January, April, July, and October for the prior quarter.

- If you have sales of investments, there will typically be realized gains and losses to record.

- Reconcile the year-to-date income and expenses to ensure that all income and expenses have been entered. This will make 1099 reconciliation so much easier during tax season.

- The Statement Account/Summary will typically provide you with a Market Value change. This typically includes Unrealized Gains and Losses, Realized Gains and Losses, and Reinvested Income.

– Make sure that your entry to Unrealized Gains and Losses ties to the Market Value change per the statement.

– Make sure that the Unrealized Gain/Loss is a reasonable amount. For example, you will never see a $1 million unrealized gain/loss in a portfolio with a $4 million value.

For more accounting tips from Plumb Family CFO, check out our YouTube channel

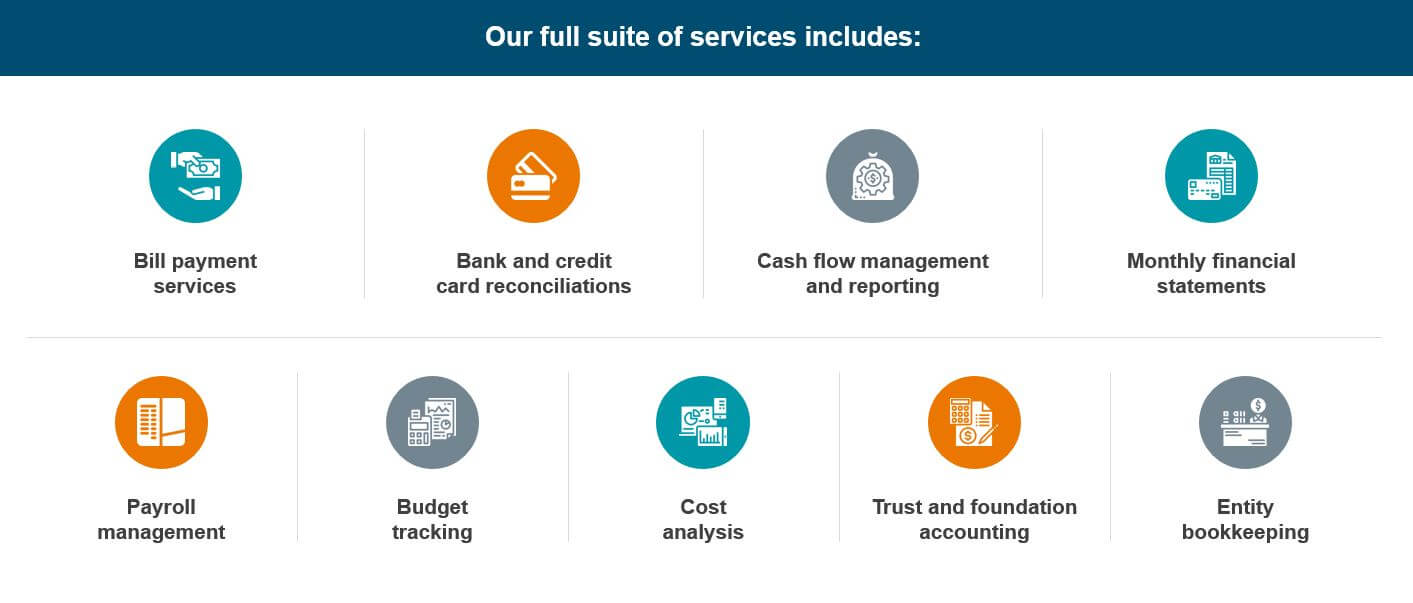

Gain financial peace of mind through Plumb Family CFO’s services:

- Family Bill Pay Services

- Personal Financial Reporting & Analysis

- Bank & Credit Card Reconciliation

- Household Employee Payroll

- Cash Flow Management

- Budgeting

- Outsourced Personal Assistant & Concierge

- Trust Accounting

Let Plumb handle your QuickBooks accounting.

Related Posts to How to Reconcile a Brokerage Statement in QuickBooks:

Find us on