This is an interview brought to you by Acclaim Magazine and Editor, Tom Burroughes for Family Wealth Report.

Cutting the Bill Payment Burden Adds Big Value For Clients

An interview with Anneke Stender, EVP of Plumb Bill Pay and Robert Scherer, President of Plumb Bill Pay.

What do you think is the main reason you have received this award-winning stage?

Plumb Bill Pay has been laser-focused to deliver an accounting service that has been either overlooked or underserved in the private client community. By offering a stand-alone outsourced bill pay solution to family offices, wealth managers and the high-net-worth, we have capitalized on a gap in the marketplace.

The interest in our “Property & Household” service offering has grown significantly in the past 18 months as the trend of outsourcing continues to rise. As a result, Plumb Bill Pay has onboarded an average of three new clients every month, adding 12 new employees to the team and expanding into three office locations across the country.

“We believe that our firm has achieved this award-winning stage based on the combination of providing high-touch customer service that is built on a technology platform with bank-level security while operating with proven accounting systems and procedures,” said Robert Scherer, President of Plumb Bill Pay.

The financial teams who engage Plumb Bill Pay as their back-office to process and pay client bills gain a competitive edge with a wide range of benefits. Our service improves their business processes, which frees up time for their team to focus on investment strategies and higher-level accounting functions. It enhances their service offering by having a trusted resource for their clients who are overwhelmed with the amount of bills to pay and expenses to track. With our established security protocols and checks and balances, the burdens of compliance, risk and cybersecurity that come with processing payments and potential fraud are diminished when outsourced to Plumb Bill Pay.

What sort of challenges did you have to take on?

Working as a vendor for some of the world’s largest financial institutions, the security of our platform and internal controls to protect confidential information was built on unique and stringent specifications. We believe it is imperative for clients and their financial managers or designees to be able to maintain access to the bill pay workflow, but without compromising security.

We took on the challenge to build a customized cloud network that is backed on a singular data center. It is certified and compliant for bank standards with two-factor authentication and VPN connection. We also setup procedures and role-based workflows for approval limits and constantly monitor accounts for suspicious activity.

What can you tell us about how your colleagues contributed to this success?

As our firm experience’s rapid growth, we shifted the structure of our bill pay teams for optimal customer service. Every bill pay client is supported by at least 3 accounting experts, ranging from a dedicated manager, to associates, an account supervisor and signors. This allows for the appropriate checks and balances, while also giving the client and their personal financial team access to Plumb when they need them.

Since we work with successful and fast-paced entrepreneurs and affluent families, they have a lot of moving parts to their financial structure. Our personal bill pay teams understand the unique needs of the high-net-worth and provide the white glove customer service they require and deserve. Clients gain financial peace of mind knowing their household expenses are being handled, while also having clear insights into their finances with cash flow reports and tracking.

How have you dealt with the changes taking place in the North American wealth management market and in what way did your award reflect that?

Many of the wealth managers and financial advisors who refer to our personal bill pay services are looking for a reliable resource to handle their client’s complex bill pay service needs. It’s a competitive marketplace in the North American wealth management market in order to attract and retain high-net-worth clients. By offering a solution that reduces the overwhelm of managing multiple bills and chasing due dates, wealth managers can turn to Plumb for support. We work alongside them and customize our accounting services, reporting and security measures depending on their current operations.

From whom do you take inspiration, either in terms of people or other organizations, inside or outside the North American wealth sector?

“Our inspiration to deliver a superior bill pay service comes from our experience with working with some of the country’s largest investment firms and family offices,” said Anneke Stender, Executive Vice President of Plumb Bill Pay. “We admire their far-reaching approach and ability to provide such massive resources and options for their clients.”

What sets you apart from your peers this year?

For over 20 years, Plumb has been providing back-office accounting and financial reporting to businesses and high-net-worth families. It is this depth of knowledge and our corporate finance approach to handling bill pay and multi-entity bookkeeping for the private client community that stands out above the rest.

We understand the business-sized challenges of high-net-worth clients who have a complex financial life. The families we work with have an average of 100 – 200 bills to pay each month, plus 3-4 entities to track. By producing cash flow reports with an up-to-date general ledger system, clients and their advisors have clear insights into their wealth to make decisions based on their financial goals.

What will you do to keep the standard of an award-winner and push ahead in the future?

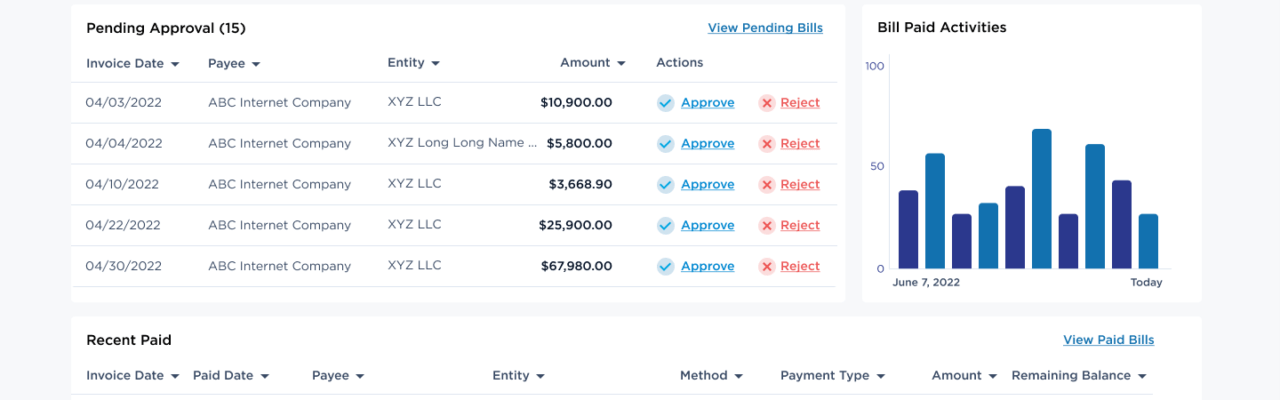

Prior to winning this award we started the development of our Bill Pay App. It is now complete, and we have begun staged roll outs. This workflow application will be used as a tool to automate the bill pay process and enhance the client experience. By applying this forward-thinking technology, it will give us another tool to push ahead in the future.

Contact Plumb for a demo of our Bill Pay app.

What do you hope will be the main consequence of achieving this accolade?

This award brings us incredible exposure to a community that may not be familiar with our outsourced solution for bill pay. Our current clients, some of whom are the wealthiest people in the country, love Plumb Bill Pay. It is their confidence in our service that drives us forward.

We hope it will bring attention to a service that can help financial management teams spend less time handling administrative bill pay functions and more time working alongside their clients to help strengthen financial futures.

How will you use the award to raise your profile in the industry among clients?

As a first-time nominee, we have been following the FamilyWealth Report Awards and their community of contributors for years. It is an honor to be recognized and we will continue to publicize our award online and within our marketing collateral.

For a list of all the award winners and their interviews, view the Acclaim Magazine.

Interested in a quote for bill pay services?